IRCTC (Indian Railway Catering and Tourism Corporation) is an Indian government company that provides catering, tourism, and online ticketing services for Indian Railways. This company was established in 1999, and its primary objective was to improve services for the passengers of Indian Railways.

Some important services and features of IRCTC are:

Online Ticketing: IRCTC has a major service portal from where people can book train tickets online. This platform is the most used platform for booking train tickets.

Catering Services: IRCTC provides catering services on trains and stations of Indian Railways. There is a wide variety of food options available here, such as meals, snacks, and beverages.

Tourism: IRCTC also offers travel packages, which include tours, pilgrimage trips, and other tourism-related services. These packages are specially provided through the train services of Indian Railways.

Rail Neer: IRCTC also operates a bottled water brand called “Rail Neer” which is available on trains and stations.

E-Catering: Passengers can order their favourite food during their journey through IRCTC’s e-catering service.

IRCTC’s shares are listed on Bombay Stock Exchange (BSE) and National Stock Exchange (NSE) and it is a public company.

📊 IRCTC Report (2025) – Understand in easy language

🔹 1️⃣ Company’s Financial Performance

✅ Revenue (Company’s earnings)

Earnings in FY23: ₹3,540 crores

Growth from last year: +88% (Business grew rapidly after Covid)

Earnings in Q3 FY24: ₹1,118 crores

Growth from Q2: Around +7.5%

Revenue is increasing continuously due to ticket booking, catering and tourism.

✅ Profit and Margin

Gross Margin (Total Profit): 60–65%

Operating Margin: 35–38%

Net Profit Margin: 28–30%

Special feature of IRCTC: It has a monopoly in railway ticketing, which gives more profit.

✅ EPS (Earnings per Share)

TTM EPS (FY24): ₹12.5–13.5

Yearly growth: +18–20%

Expected to grow at 15–18% CAGR in next 2–3 years.

✅ Debt Status

Debt-to-Equity: 0 (completely debt-free company)

Interest Expenses: None, as there is no debt.

✅ Cash Flow

Operating Cash Flow per year: ₹1,200+ crores

Free Cash Flow: More than ₹1,000 crores

IRCTC has a very strong financial position – low expenses and high earnings.

🔹 2️⃣ Valuation

📈 P/E (Price-to-Earnings Ratio)

Current P/E: ~55x

Historical range: 45x to 80x

Market has faith in IRCTC’s business model and growth.

📈 P/B (Price-to-Book Ratio): ~16x

Shows that the company is trading at a premium value.

📈 EV/EBITDA: ~38x

Much higher than normal tourism companies.

📈 Dividend Yield: ~1.3%

Regular dividend paying company.

🔹 3️⃣ Growth and Competition

🚆 Growth Factors:

Increasing trend of tourism

New trains like Bharat Gaurav, Vande Bharat

Increase in digital ticketing

Government investment in railways

🏆 IRCTC monopoly:

Sole right on online railway ticketing

Exclusive license in railway catering and Rail Neer (bottled water)

New competitors cannot come due to government involvement

🔹 4️⃣ Risk

⚠️ Market Risk:

Dependent on tourism and inflation

Government interference is always there

⚠️ Operation Risk:

Cyber risk of ticketing website

Catering supply chain problems

Railways may ban fees

🔹 5️⃣ Latest News and Catalyst (May 13, 2025)

Q4 FY25 results coming: Investors are waiting

New tour packages launched: Focus on religious and eco-tourism

Ticketing system upgrade: Partnership with TCS and RailTel

News of government stake sale: Speculation of 5–10% stake sale

No new government policy: No major change right now

✅ If we look at it from Buffett’s perspective, should we buy IRCTC?

Checkpoint Status

🛡️ Monopoly (Moat) ✔️ Very strong (hold over ticketing + catering)

💰 Consistent profitability ✔️ Yes, growing EPS and margins

🚫 Debt ✔️ None

🔁 RoE ✔️ 35–40% (among India’s best)

📖 Business worth understanding ✔️ Easy – ticketing, tourism, water

👨💼 Management 🟡 Professional but government

💸 Value ❌ P/E too high – Buffett hates it

What would Buffett do?

“The company is great, but I would buy it at a low price.”

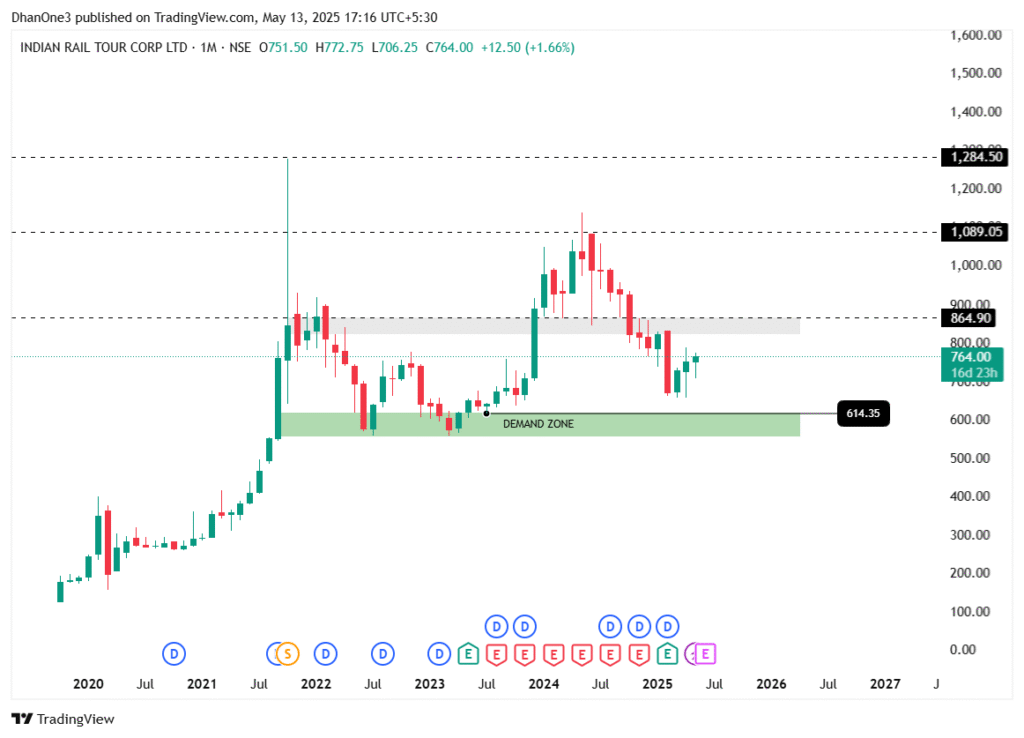

📉 Chart Pattern (Technical Analysis) – Cup & Handle

Fell from ₹1,284 to ₹614 and now slowly moving up

Cup formation has been formed, now if Handle is formed then breakout is possible

Breakout Level: ₹864–₹890

Target: ₹1,089 and ₹1,284

Support Zone: ₹614–₹640 (Good buy level)

📌 Investment Decision – What to do?

🔵 Short-term: A little uncertainty, but there can be a chance on the dip

🟢 Long-term: Full possibility of growth due to digital and tourism

✅ Action: It is a good company – buy and hold on dips.

READ MORE – LIC Housing Finance – Share Price Prediction