Cello World Ltd is an Indian consumer brand that manufactures daily-use products like bottles, lunch boxes, kitchenware, pens, pencils, and plastic furniture.

The company focuses on mass market + repeat use products – which are regularly in demand in every home, school and office.

This brand is available in 1 lakh+ retail outlets and exports to 60+ countries. Due to its in-house manufacturing, it maintains control on both product quality and margins.

In simple words – It is a household brand whose business is both stable and scalable.

🏢 1. What does the Cello World Ltd do? (Business Model)

Cello World Ltd is a company that makes daily products used in everyday life. Like:

- Bottles, lunch boxes, kitchen containers

- Pens, pencils, markers (for school-office use)

- Plastic furniture – chairs, tables, stools

- It is also exported to 60+ countries

- Their network is quite strong. These products are available in more than 1 lakh shops. Their manufacturing is also our own – due to this both margin and quality are under control.

In simple words – this is a mass consumption company. Demand is stable, and it makes things that are needed in every home.

🧠 2. What has Mutual Fund done in this? (Fund Activity Analysis)

Source- RUPEEVEST

- Mutual funds have made a good entry in April 2025.

- From Jan to March, fund holding was a little unstable, but…

- In April, approximately 14 lakh new shares were added.

- 27 mutual funds are invested in this stock.

This clearly shows that institutions see the future of this company as strong. When smart money enters, retail should be alert.

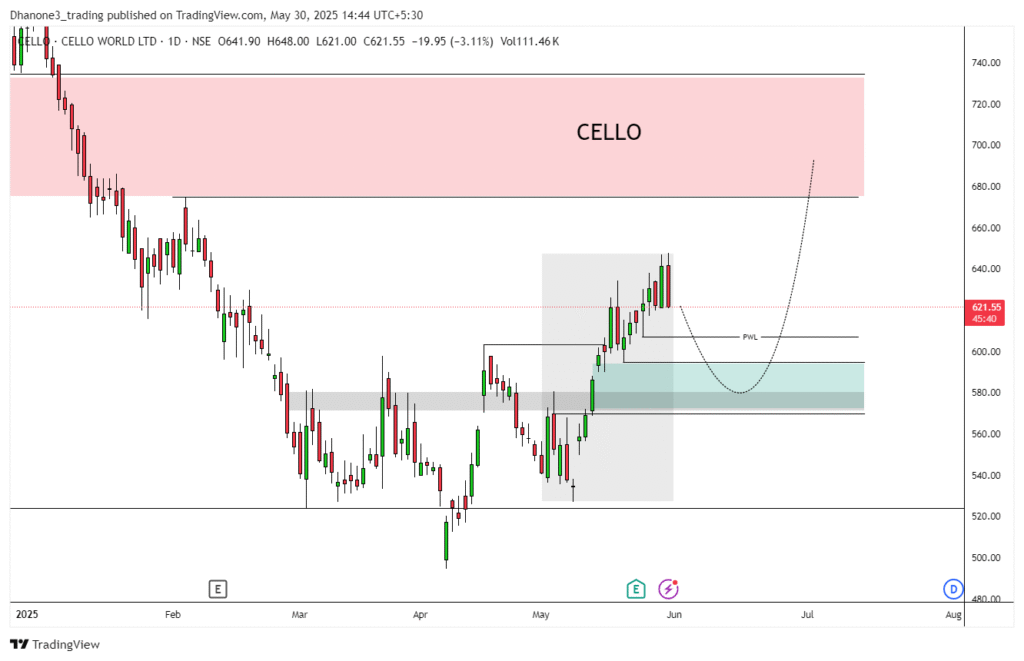

📉 3. Chart Analysis – What is Price Action saying in Cello World Ltd

In April-May the stock gave a strong breakout.

Now the price is coming back and entering an important demand zone of ₹585 – ₹600.

This zone was a bounce zone earlier as well – meaning buyers are active here.

✅ Entry should be made when a good green candle is formed after the red candle.

🛑 Stop Loss – low of the green candle.

🎯 Target – zone of ₹680 – ₹705.

Risk-to-reward is good, but entry should not be taken without confirmation.

📊 4. What investment should be made? (Advisory View)

If you look at all the things:

- The business model is solid

- The trust of mutual funds is visible

- The chart is near the demand zone

- There is also future growth potential

So this can be a good stock for long-term investors. You can buy in this zone little by little.

If you are a short-term trader, then take entry only when you get confirmation – otherwise SL can be applied.

🎯 5. Final Advice – No Entry Without Confirmation

Not every setup in the market gives money – money is given only by that setup in which there is logic, patience and confirmation.

So if you also want to learn:

How to read a chart

How to track smart money

And how to use demand zones and breakouts

Then my mentorship program is for you. I teach every concept in my simple language, along with the live market.

📣 Follow me on Instagram, Telegram and YouTube.

If you have any questions, ask in the comments, I will personally reply.

“📊 When you understand the market, then you do not feel afraid to take trading decisions.”

ALSO READ- In AWL Agri Business ltd- Fii & Dii Increase Holdings. Price Target ?