In this post, we have done a complete analysis of the business of Indian Oil Corporation (IOC) – how this company works, what is its future plan like battery, EV charging and entry into green energy. Along with this, we have also told the chart setup in which you will get exact entry, stop loss and target. If you are a trader or a long-term investor then this post is very useful for you.

What does the Indian Oil Corporation do?

IOC is India’s largest oil company – it manufactures and sells petrol, diesel, LPG, jet fuel, and many other oil products. It is a government company whose job is to manage the supply of oil in the whole country – from refinery to petrol pump!

Business Model – How does IOC work?

Refining (Oil production):

IOC has 11 large oil refineries (like Panipat, Gujarat, Paradip). Where crude oil is converted into petrol, diesel, LPG.

Pipeline Network (Oil Delivery):

They have more than 20,000 km of pipeline through which they transport crude oil and finished products across India.

Petrol Pump & LPG (Selling):

IOC has petrol pumps (27,000+) in every corner of India and also sells LPG cylinders under the name “Indane”. They are active in both rural and urban areas.

They also search for oil (Exploration):

IOC not only produces oil but also searches for oil and gas in many areas of India and outside.

Petrochemicals (Plastic, Chemicals are made):

These people also make chemicals and plastic raw material from the waste material coming out of refineries.

🌱 What is IOC doing next?

- Indian Oil now does not want to be limited to just oil. It is entering new sectors:

- Battery & EV charging

- Nuclear power

- Data centers

- Green energy (renewable)

Their target is to earn an income of ₹1 lakh crore (1 trillion ₹) by 2047!

📈 What is the scene of money and finance?

Revenue: Around ₹7.7 lakh crore (as of 2023)

Dividend yield: Around 12% – means it also gives good money to the shareholders

ROE (Return on Equity): Around 20% – the company is also earning money

Debt is also at a manageable level.

Latest News Highlights on Indian Oil Corporation ( IOC )

Q4 Net Profit: ₹7,265 Cr (up 50% YoY) — major boost from inventory gains.

Expansion Plan: $1 Trillion revenue target till 2047.

New Sectors Entry: Battery, nuclear, mining, data centres.

Government has planned to invest more than ₹80,000 Cr in fuel storage and tankers for the long term — IOC will get the direct benefit. Source

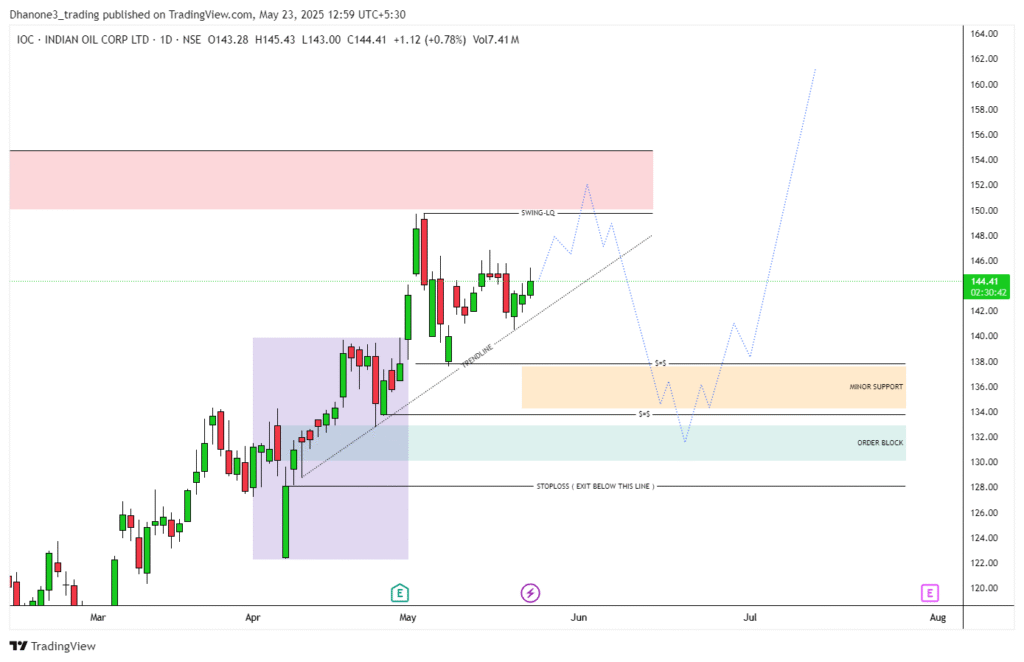

Indian Oil Corporation Chart Breakdown 2025

Current Price – ₹144.65

Setup Explanation:

The price is currently holding at the trendline support.

Rejection was received near the Swing Liquidity (SWING-LQ) zone from above, from where the price is repeatedly getting rejected.

Now two scenarios can happen from here:

Scenario 1 – Aggressive Entry (Breakout Play):

If the price breaks the swing high and gives a closing, then a breakout trade is formed.

But if the liquidity sweeps and again gives a red candle, then rejection will be received.

It is better to avoid here until there is a clear breakout.

Scenario 2 – Smart Money Entry (Liquidity Grab Setup):

Price comes down, breaks minor support (orange zone).

Then the order goes up to the block zone (blue zone) where institutions had bought earlier.

Here we will wait for a strong bullish candle – which gives a green candle after the red candle (change of character).

The low of that green candle will be our Stop Loss.

Entry Plan In Indian Oil Corporation

Zone: ₹132–₹137 (end of order block)

Entry Confirmation: Green bullish candle after liquidity sweep

Stop Loss: Green candle low (below around ₹128)

Target 1: ₹145

Target 2: ₹152

Extended Target: ₹160+ agar structure breakout given

Risk Reward Ratio:

Approx 1:2.5 to 1:3 — solid setup if confirmation is received.

🛢️ Should I buy IOC stock?

If you are a long-term investor and trust the government company, then IOC is a stable dividend stock. But if you want high growth tech-type return, then it can be a bit slow.

Related Questions:

1️⃣ What is the share price of IOC in 2025?

The price of IOC is currently trading around ₹144 in 2025. According to chart analysis, if the price forms a bullish candle in the order block zone of ₹132-₹137, then the short term target can be ₹152–₹160.

But if the price breaks out and the overall trend of the market remains bullish (crude oil supply demand remains stable), then it can also go up to ₹170–₹180 by the calendar year end.

Note: All this is possible only when the company’s quarterly results and global oil sentiment remain positive.

2️⃣ What is the future price of IOC in 2030?

The price prediction till 2030 fundamentally depends on sector growth. IOC is now diversifying away from traditional oil into new business segments like renewables, battery storage, EV infra, and nuclear energy.

If the company is successful in its expansion plans and keeps margins stable, then:

Conservative Estimate: ₹260–₹300

Aggressive Bull Case: ₹350+

The logic behind this is IOC’s strong distribution network, PSU advantage and “Make in India” push which can give it stable returns in the long term.

3️⃣ What is the future of IOC share?

The future of IOC depends on 3 major pillars:

1. Diversification Strategy:

Entry into new sectors like battery storage, hydrogen fuel, solar projects – this is a positive signal for the long term.

2. Government Support:

Being a PSU, the company always gets support on infrastructure and import-export front.

3. Dividend Track Record:

IOC has been giving regular and strong dividends – which means it also becomes a cash flow generating stock for investors.

So if you are a long-term investor who wants both dividend + growth, then IOC can be a reliable and stable pick.

If you make smart entries as per the charts and invest with patience, Indian Oil Corporation IOC can become an energy powerhouse in your portfolio – with potential up to ₹160 in the short term and ₹300+ in the long term.

READ MORE – Sun Pharma Stock Analysis: Business Model, Revenue, and Market Impact