- Founded in 1977 by Padma Shri awardee Rajni Bector in Ludhiana, Punjab

- Operates two flagship brands: Mrs Bector’s Cremica (biscuits) and English Oven (premium bakery)

- Manufactures ~400 SKUs including cookies (e.g., Bourbon, Glucose), breads, pizza bases; also co-manufactures for Oreo & Chocobakes

- Strong domestic distribution (26 states, 580,000 outlets) and exports across ~70 countries.

- Institutional clients include McDonald’s, KFC, Subway

🏭 Mrs. Bectors Food Specialities Ltd Business Model – Simple and Strong

- Product Range: Biscuits, Cookies, Breads, Pizza Base, Buns, Cakes

- Brands: Cremica (biscuits), English Oven (premium bread)

- Distribution: India ke 26 states mein active + 70+ countries export

- Retail Network: 5.8 lakh+ retail outlets

- Clients: There is a tie-up with major fast food brands in B2B as well

The company’s business model is consumer-based, which has a little impact on the price of raw material, but the demand remains stable.

📊 Financial Performance (FY25) of Mrs. Bectors Food Specialities Ltd

- Revenue Growth: 15.4% YoY – good growth, especially for the food sector

- Net Profit (Q4 FY25): ₹34.28 Cr – stable and consistent

- EPS Growth Rate: 21% – strong earnings power

- ROE (Return on Equity): 20% – good return on shareholders’ money

- Cash Flow: ₹22.62 Cr – positive operational performance

- Debt Level: Very Low – company debt-light hai, matlab financial risk kam

📌 The company is growing profitably, and cash flow is also strong.

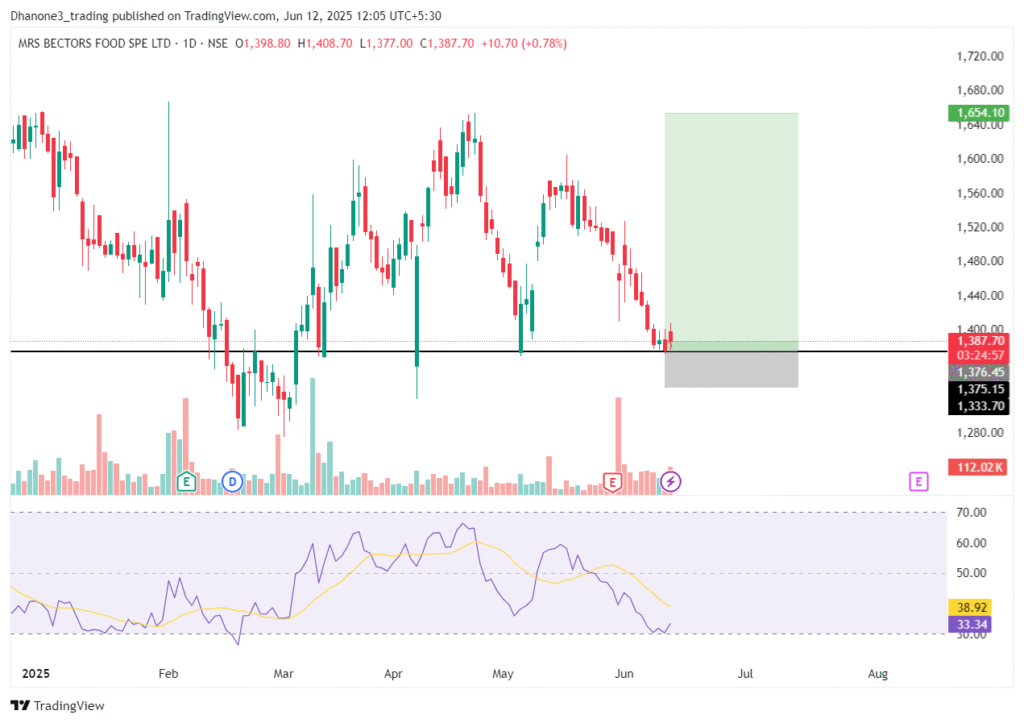

📈 Technical Analysis – What do you understand from the chart?

- CMP: ₹1,403.50 (as on June 12, 2025)

- Support Zone: ₹1,375 – ₹1,357

- RSI: 37.4 (oversold zone, reversal possible)

- Price Action: It is bouncing near Support with volume spike

📌 A setup for reversal trade is being formed for short-term. Risk-reward is favourable.

🧠 Mutual Fund Holdings – What is Smart Money saying?

| Month | No. of Funds | Shares Held |

| Jan 2025 | 55 | 1.14 Cr approx. |

| Feb 2025 | 56 | 1.14 Cr |

| Mar 2025 | 58 | 1.15 Cr |

| Apr 2025 | 59 | 1.15 Cr+ |

every monthThe stake in mutual funds is increasing, which is a big bullish signal.- 59 funds are holding the stock – this shows the confidence that smart money is betting on this stock.

🟢 Green Flags – Risk Free Stock?

| Risk Check | Status |

| ASM/GSM Surveillance List? | ❌ it is not |

| High Promoter Pledging? | ❌ Zero |

| Penny Stock? | ❌ Want |

| High Debt? | ❌ Want |

| Low Liquidity? | ❌ No issue |

| Is institutional holding low? | ❌ No – Funds are active |

📌 The stock is absolutely clean – there is no compliance or governance issue.

💸 Valuation Insights – Cheap or expensive?

- Current P/E: 71x (Premium valuation)

- Historical P/E Range: 39x – 103x

- Intrinsic Value Estimate: ₹900 – ₹1,000 (some models)

- Analyst Target: ₹1,620 – ₹1,875 (12-month view)

📌 The stock is definitely expensive, but the premium is justified due to the strong brand and consistent growth.

Also Read – In AWL Agri Business ltd- Fii & Dii Increase Holdings. Price Target ?

📰 Latest News Highlights (Q1 FY25)

- Q4 result positive – Revenue up 10.8%, PAT ₹34 Cr

- Dividend declared – ₹3/share

- New plant expansion – Indore, Kolkata, Maharashtra

- Naye product launch – Shortbread, Animal Cookies

- Red Sea shipping disruption ka thoda impact margins pe pada

🎯 Investment Decision – Dhanone3’s Final Opinion

✅ Is it good?

- Brand value strong hai (Cremica, English Oven)

- I trust the mutual fund

- Financials stable & consistent

- No debt, no pledging, no NSE red flags

- I am in the mood for chart setup reversal

⚠️What will have to be handled?

- P/E 71x → valuation thoda premium hai

- The pressure of raw material and logistics is expected on the margins

🔍 Trading View (Short Term):

- Entry Zone: ₹1,375 – ₹1,400

- Stop Loss: ₹1,345

- Target: ₹1,620 – ₹1,650

🧾 Investing View (Long Term):

- SIP is phased buying now

- Target within 12 months: ₹1,750

- Dividends are also being received, so long-term hold is worth it

This stock is perfect for those who are looking for long-term investment in branded FMCG stocks. It is definitely a bit expensive, but fundamentals and market trust are strong – so accumulate slowly, don’t panic.