Sun Pharma is India’s largest and world’s sixth largest pharmaceutical company. It is a global leader in generic and specialty medicines and operates in different therapeutic areas.

Core Business Areas: Sun Pharma

- Generics: Production and distribution of generic medicines.

- Specialty Drugs: Strong presence in niche segments such as Dermatology, ophthalmology, onco-therapies.

- APIs (Active Pharmaceutical Ingredients): These provide raw materials used to make medicines.

- Over-the-Counter (OTC) Products: Direct-to-consumer health care solutions.

Global Reach: Sun Pharma

- Sun Pharma has a footprint in 100+ countries.

- Its major revenue comes from US, India, and emerging markets.

- Research and Development (R&D):

- High focus is on R&D which includes development of specialty drugs and biosimilars.

- They invest 7-8% of their revenue on R&D.

Acquisitions and Expansions:

The acquisition of Ranbaxy Laboratories was its biggest milestone which strengthened its hold in the Indian and global market.

- Therapeutic Areas:

- Cardiovascular

- Neurology

- Dermatology

- Diabetes

- Oncology

- Gastroenterology

Revenue Model:

- A major part of revenue comes from branded generics and APIs.

- US regulatory approvals like ANDA filings are quite aggressive.

Investment Potential from Chart Analysis

Your chart analysis shows a systematic strategy based on price action. As you mentioned the order block, both fundamentals and technicals of Sun Pharma are strong. But it is important to consider market sentiments and upcoming events of the company.

Sun Pharmaceutical Industries Ltd. (Sun Pharma) has reported its Q3 FY25 (October–December 2024) financial results, in which the company has shown strong performance.

📊 Q3 FY25 Financial Highlights

- Gross Sales: ₹13,436.9 crore, which is a growth of 10.5% over last year.

- Adjusted Net Profit: ₹2,903.3 crore, showing 15% YoY growth.

- India Formulation Sales: ₹4,300.4 crore, showing a growth of 13.8%.

- US Formulation Sales: $474 million, showing a slight decline of 0.7%.

- R&D Investment: ₹845 crore, which is 6.3% of total sales, slightly higher than last year’s ₹824.5 crore.

🧪 Recent Developments

Acquisition of Checkpoint Therapeutics: Sun Pharma has acquired US-based Checkpoint Therapeutics for $355 million, which will strengthen its oncology and immunotherapy portfolio.

Anti-Obesity Drug Development: The Company is working on a new anti-obesity and type 2 diabetes drug ‘Utreglutide (GL0034)’, whose global launch is expected in the next 4-5 years.

⚠️ Market Impact

Today, on 12 May 2025, after US President Donald Trump’s announcement of drug price cuts, Sun Pharma’s stock fell 4.6%, as revenue pressure from the US market is expected to increase.

📈 Investment Outlook

Sun Pharma’s strong domestic growth and focus on specialty drugs make it a promising long-term investment. But, keeping in mind regulatory changes and pricing pressures in the US market, short-term volatility is likely.

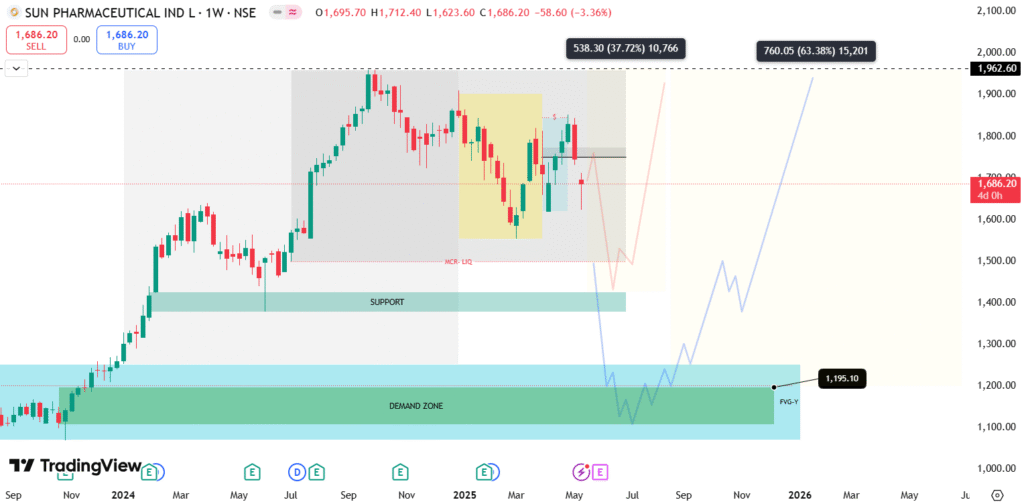

The chart shows Sun Pharmaceutical Industries Ltd. on a weekly timeframe with key technical levels marked. Below is an analysis based on visible zones and patterns:

Key Observations:

Demand Zone (Support):

Highlighted in green near the price range of ₹1,150–₹1,200, this area represents a strong support zone where demand is likely to emerge.

Price may rebound if it enters this zone, making it an attractive entry point for long-term investors.

Resistance Zone:

The price faced resistance near ₹1,960 (marked at the top). This level represents a potential exit point for profit booking.

Fair Value Gap (FVG):

The chart highlights an FVG (Fair Value Gap) around the demand zone. If the price revisits this area, it could fill the gap before moving upward.

Projected Move:

A potential bullish reversal is suggested after a dip into the demand zone, with the next targets around ₹1,700 (interim resistance) and ₹1,960 (previous highs).

Trading Plan:

Entry Points:

- Conservative Entry: Near the ₹1,150–₹1,200 demand zone, after confirmation like a bullish candlestick pattern or an increase in buying volume.

- Aggressive Entry: If price breaks and retests ₹1,700 (interim resistance), signaling continuation towards the highs.

Exit Points:

- Partial Exit: Around ₹1,700 if entering from the demand zone.

- Full Exit: Near ₹1,960, the resistance zone, unless strong momentum suggests a breakout.

Risk Management:

- Place a stop-loss slightly below the demand zone, around ₹1,100, to limit potential losses.

- Ensure risk-reward ratio is at least 1:2 before taking the trade.

Disclaimer:

This analysis is for educational purposes only and does not constitute financial advice. Stock trading involves risks, and past performance does not guarantee future results. Always consult a financial advisor before making investment decisions.

Related Questions-

1. What is the future prediction for Sun Pharma share?

Sun Pharma’s future predictions depend on its strong domestic growth, global expansion, and specialty drugs. The company invests heavily in its R&D and is strong in niche therapeutic areas such as dermatology and oncology. If regulatory challenges and pricing pressure are handled well, good stock returns are expected in the long-term.

2. What is the share price of Sun Pharma in 2030?

Sun Pharma’s share price is expected to grow by 2030 based on its business expansions, R&D initiatives, and global market reach. If the company achieves its financial targets and maintains its position in the US market, a price closing range of ₹3,000–₹4,000 can be expected. But this is just a prediction and depends on market conditions.

3. What is the future prospect of Sun Pharma?

The future prospect of Sun Pharma is quite promising as it is a global leader in generic and specialty medicines. Its development of innovative drugs such as “Utreglutide” for anti-obesity and diabetes and the acquisition of Checkpoint Therapeutics further strengthen its growth potential. But, pricing pressures in the US market and regulatory changes could be a risk factor.

4. What is the share price of Sun Pharma in 2050?

It is difficult to predict till 2050, but if Sun Pharma maintains its current growth trajectory and launches new innovations, it could become a blue-chip stock. Its share price could go up to ₹10,000+, but it will also depend on macroeconomic factors and trends in the pharmaceutical industry.

5. Is Sun Pharma a good investment?

Sun Pharma can be a good long-term investment, as it has a strong presence in the domestic and global markets. Its focus is on specialty drugs and biosimilars, which could become future growth drivers. But, in the short-term, one should invest keeping in mind the pricing pressures and regulatory challenges of the US market.

6. Which stock is better: Sun Pharma or Cipla?

Both Sun Pharma and Cipla are Indian pharmaceutical giants but their focus is different. Sun Pharma is more aggressive in specialty drugs and the US market, while Cipla’s focus is on domestic and respiratory medicines. If you need global growth potential, Sun Pharma is a better option. But, if you are looking for safe domestic returns, Cipla could be a good choice.

READ MORE RELATED- ABB India Limited Share Price Prediction