ABB India Limited – Company Information

About the Company: ABB India Limited is a large engineering company. It manufactures electrical, robotic, machine automation and energy saving systems. Its main goal is to make industries better and environmentally friendly. It also works on renewable energy.

ABB India Limited Business Model:

ABB India mainly works in these areas:

- Electrification: Making electrical equipment for homes, offices and factories.

- Motors and Drives: Making equipment that runs machines fast and accurately.

- Automation: Creating systems to simplify factory processes.

- Robotics: Making robots working in factories.

- Energy Solutions: Creating systems for saving and smart use of electricity.

ABB India’s future prospects

ABB India’s future is bright due to:

- New government projects: Emphasis on clean energy and infrastructure in India, which will increase the demand for ABB’s products.

- Digital factories: New technologies are driving the demand for automation and robotics.

- Green energy: The world is moving towards green energy, and ABB is helping in this.

- Electric vehicles (EV): ABB makes EV charging systems, which is becoming a big market in India.

ABB India’s Shareholding data

Investors have been showing increasing interest in ABB shares in the last few months.

Month Number of shares

- December 2024 ( 76,46,462 )

- January 2025 ( 80,11,563 )

- February 2025 ( 87,98,291 )

- March 2025 ( 95,27,170 )

This shows that big investors are trusting the company.

ABB India Share Price 2030

ABB India share price is expected to reach ₹8,000 to ₹8,500 by 2030. This is due to the increasing demand for renewable energy and automation.

ABB India Share Price 2025

Its target is ₹6,500 to ₹7,500 by 2025. This can be possible due to institutional investment and increasing projects.

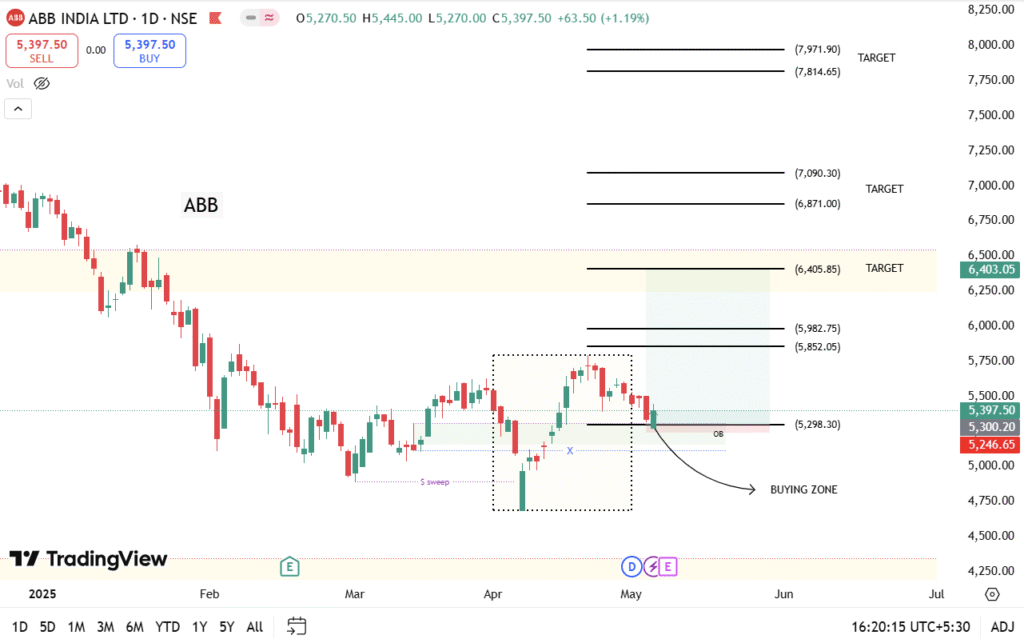

Tips for buying and selling stocks

Buying range: ₹5,298 – ₹5,300

Target:

- 1st: ₹6,405

- 2nd: ₹7,090

- 3rd: ₹7,814

Stop loss: Consider selling the stock if it falls below ₹5,246.

Why can ABB shares fall?

If the stock price falls, it could be due to:

Market downturn.

Profit booking by big investors.

Delay in a project.

ABB share price forecast tomorrow

As per technical data:

Resistance: ₹5,850 – ₹6,000

Support: ₹5,300 – ₹5,400

Disclaimer:

This information is for learning purposes only. Consult your financial advisor before investing. Investing in the stock market can be risky. Follow SEBI and NSE regulations.

Conclusion:

ABB India is a strong company with a bright future. But always invest wisely and after doing your research.

2 thoughts on “ABB India Limited Share Price Prediction”