Suzlon Energy: Company Overview & Technical Outlook

About the Company

Suzlon Energy was established in 1995 and is headquartered in Pune. It is one of the prominent players in the wind energy segment in India. It produces wind turbines, executes wind farm projects, and provides maintenance services to the world at large with a mission to provide cost-effective clean energy.

What Makes Suzlon Special?

- Focus on green & renewable energy

- Global presence

- Cost-efficient technology-driven operations

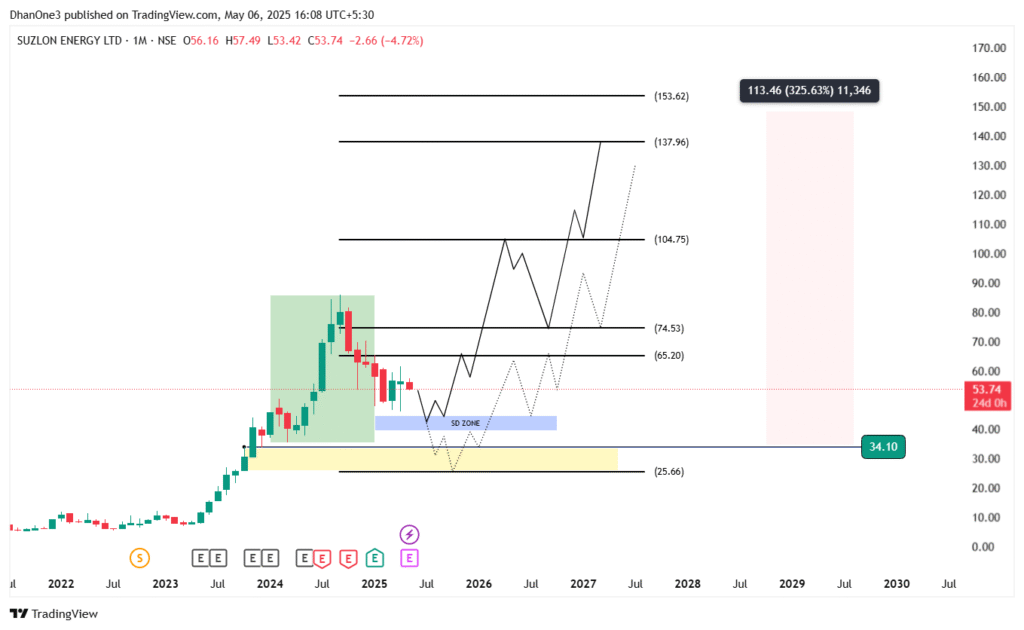

Suzlon Energy Price Target – Technical Analysis

Current Price: ₹53.74

Support Zone (Buy Range): ₹34.10 – ₹40

Stoploss: ₹25.66

Resistance/Targets:

₹65.20 (short-term)

₹74.53 (mid-term)

₹104.75, ₹137.96, ₹153.62 (long-term)

Chart Insights:

- Strong demand zone formed

- Breakout from consolidation suggests upside potential

Strengths & Financials

- Significant debt reduction

- Leading position in wind energy in India

- Healthy order book signaling growth

Investment Strategy

Entry: ₹34.10 – ₹40

Stoploss: ₹25.66

Targets: ₹65.20, ₹74.53, ₹104.75, ₹137.96, ₹153.62

Risks

- Policy changes may impact growth

- Debt recovery still critical

- Market volatility

Conclusion

Suzlon Energy is a good long-term investment prospect with sound fundamentals and technical strength. Optimal entry between ₹34.10 and ₹40.

Disclaimer: This is content is only for educational purposes. Do your own research before investing.

1 thought on “Suzlon Energy Price Target – 2025”